In this article, we are going to talk about federal taxes in Brazil. This country is full of opportunities and with room for great business, whether in the fields of health, technology, finances, services, or products. When an investor, company, businessman, or entrepreneur from another country thinks of opening a business in Brazil, one of the main questions is how federal taxes in Brazil impact their operations.

Compared to other countries, taxes in Brazil are calculated in a different manner and depending on the economical point of view, Brazil seems to have a higher tax burden for some taxpayers.

However, for us to evaluate the tax burden in Brazil, it is necessary that we analyze how other countries organize and collect their taxes. For example, the USA, United Kingdom, Germany, and China use a very different format than that of Brazil. Some collect taxes upon income, others upon products and services. Federal taxes in Brazil play a significant role.

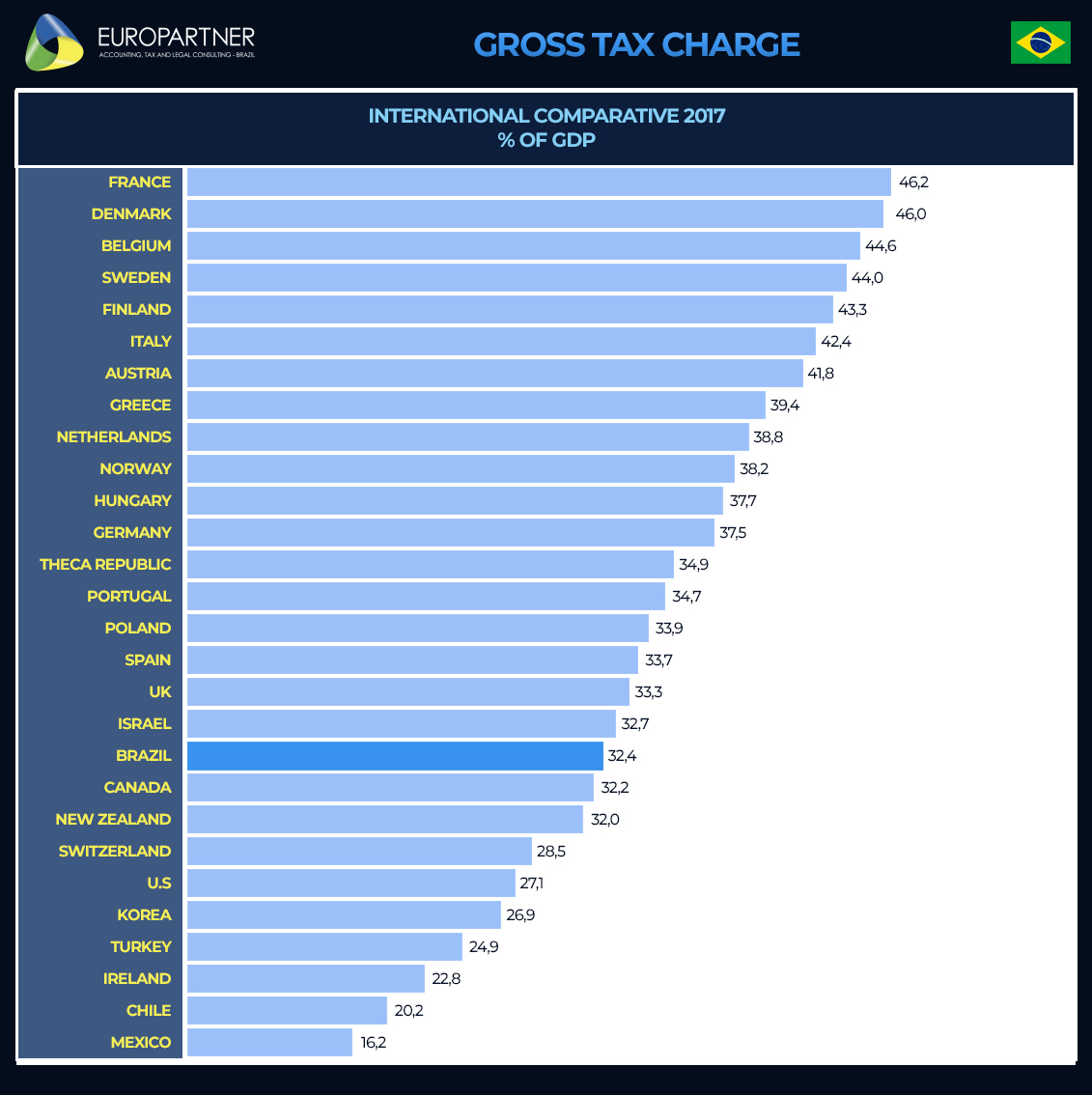

Regardless of the argument, the tax burden in Brazil considered high sometimes is lower than that of other countries considered to be more developed.

However, in Brazil, since lower social classes pay the same taxes as the higher classes, the collecting becomes unfavorable.

Nevertheless, this is being discussed in Brazil and soon there will be changes benefiting Brazilians and investors, making Brazil even more interesting for investments.

See in this 2017 chart a ranking of tax burdens in the World’s largest GDPs, see that Brazil is at the 19th position, with a lower tax burden than many countries in Europe.

In order to understand how federal taxes in Brazil are distributed and collected, the accounting team of EUROPARTNER BRASIL created a list with the main taxes collected in Brazil, including federal taxes, and the percentage collected by them.

Federal Taxes

It represent 65,95% of all taxes collected in Brazil. recognized by acronyms, the main ones are:

CIDE: Contribuição de Intervenção no Domínio Econômico (Contribution of Intervention in the Economic Domain). It is payable on gas, compressed natural gas and its derivatives, and also on ethanol fuel.

IPI’s Aliquot: In oct/16, the value was stipulated at R$ 100,00 per cubic meter of gas and its chains, and R$ 50,00 per cubic meter of diesel and its chains. Other derivatives, in general, are not subjected to tax.

COFINS: Contribuição para o Financiamento da Seguridade Social (Contribution for the Financing of Social Security). It is collected from companies. The general COFINS aliquot is of 7,6% for non-cumulative systems and of 3% for cumulative systems.

CSLL: Contribuição Social sobre o Lucro Líquido (Social Contribution on Net Profits). Its objective is to finance Social Security and its collecting is mandatory for all legal entities domiciled in Brazil, and the ones equated to those. The CLSS aliquot is of 9%, with an exception for companies considered financial institutions, of private insurances and capitalization, which must pay CLSS in 15% of its profit.

FGTS: Fundo de Garantia do Tempo de Serviço (Severance Indemnity Fund). It’s a percentage of the salary of each registered worker deposited by the company, which is deposited in their linked account. The calculation of the FGTS value to be deposited for the apprentice, the aliquot is of 2% upon the remuneration and for the remaining employees it is 8% upon the remuneration.

INSS: Instituto Nacional do Seguro Social (National Institute of Social Security). It is responsible for the payment of pensions and other benefits of Brazilian workers who contribute to the Social Security (an insurance that guarantees a pension to the taxpayer when he quits working), with the exception of public servants. Percentage of salary of each employee charged from the company (around 28% – it varies according to the field of activity) and from the worker (8%) for health assistance.

II – Imposto sobre Importação (Import Duties): A tax on the importation of foreign goods and on the luggage of travelers coming from abroad. The aliquot depends on the publishing of the law, in the rise’s current year.

IOF – Imposto sobre Operações Financeiras (Tax on Financial Operations): It is charged upon loans, financings and other financial operations, and upon shares. The aliquot depends on the publishing of the law published in the rise’s current year.

IPI – Imposto sobre Produto Industrializado (Tax on Industrialized Goods): It is charged on industries. The tax falls upon imported goods when they are cleared at the customs sector, as well as when national industrialized products leave (the store) (IPI affects the value of everything we acquire as products). The IPI’s aliquot is calculated according to the IPI’s current table.

IRPF – Imposto de Renda Pessoa Física (Individual Income Tax): A tax on the accumulation of income (or revenue). It is charged from individual taxpayers with yearly revenue exceeding that of the exemption range imposed by the Federal Revenue. The aliquot of the IPI is calculated according to the IR’s table on received salaries and profits obtained via financial operations.

IRPJ – Imposto de Renda Pessoa Jurídica (Corporate Income Tax): It is charged upon the profit of companies. The IPI’s aliquot is calculated according to the IR table on received salaries and profits obtained via financial operations.

ITR – Imposto sobre a Propriedade Territorial Rural (Tax on Rural Land Property): A tax which taxable event is the property, right to use or possession of real estate (as defined by civil law) located outside of the municipality’s urban area. The ITR’s calculation basis is the value of the land without any further improvement or benefiting (including plantations) – the so called ‘naked land’.

PIS/Pasep: Programas de Integração Social e de Formação do Patrimônio do Servidor Público (Program of Formation of the Patrimony of the Public Servants). It is charged from companies. The general aliquot of PIS/PASEP is of 1,65% for non-cumulative systems and 0,65% for cumulative ones.

State Taxes

They are taxes collected by the states and are equivalent to 28,47% of all collected taxes, among them, the main ones are:

ICMS: Imposto sobre Circulação de Mercadorias (Tax on Commerce and Services). A tax that is charged upon operations relative to the moving of goods, including the provision of food and beverage for bars and restaurants; upon provision of interstate and intermunicipal transportation services and upon chargeable provision of communication services, even if the operations begin abroad. It is also charged upon interstate and intermunicipal transportation and telephony. The ICMS aliquot is variable according to the current state aliquots.

IPVA: Imposto sobre a Propriedade de Veículos Automotores (Automotive Vehicles Property Tax). It’s a tax that is charged upon the property of ground automotive vehicles only. It is paid every year. The value varies between states and it is calculated according to the current FIPE table [note: FIPE stands for Fundação Instituto de Pesquisas Econômicas – Institute of Economic Research Foundation].

ITCMD: Imposto sobre a Transmissão Causa Mortis e Doação (Inheritance upon Death and Donation Tax). It is charged upon inheritances. It is charged upon the transmission of any property or right obtained via legitimate succession or testamentary succession, including temporary succession; upon the transmission via donation, for any reason, of any property or right. The ITCMD aliquot is fixated by the Federal Senate and won’t be higher than 8%.

Municipal Taxes

These are taxes collected by each municipality. They are the following:

IPTU: Imposto sobre a Propriedade Predial e Territorial Urbana (Tax Urban and Land Property). A tax that is charged upon the property, right to use or possession of real estate located at an urban zone or urban extension. The IPTU’s calculation basis is the purchasable value of the real estate upon which the tax is charged and it is calculated by multiplying the purchasable value of the real state by its respective aliquot, which is defined by the municipal law.

ISS: Imposto Sobre Serviços (Tax on Services). It is charged from the companies. Its taxable event is the provision or services (by a company or an autonomous professional). The aliquot utilized varies from one municipality to the other. Also, the country, via supplementary law, has determined a maximum aliquot of 5% for all services. The minimum aliquot is of 2%.

ITBI: Imposto sobre Transmissão de Bens Inter Vivos (Inter-Vivos Property Transfer Tax). It is charged upon the shift of possession of real estate. Its taxable event is the transmission, between living persons, for any reason, by means of sale or purchase, of the property or right of use of real estate. The ITBI’s aliquot is calculated upon 3% of the property’s market value.

With around 80 different taxes and different applications, it is important that you have a specialized advisory before investing in Brazil. For that, count on the consultants from EUROPARTNER, a team specialized on Brazilian taxes.

In order to avoid waste of time or complications with the Brazilian government, contact EUROPARTNER, we will be happy to understand your needs and help you establish yourself in Brazil.

Here is a link to learn more :