Employer of Record: the smart strategy to delay company formation and start operating safely

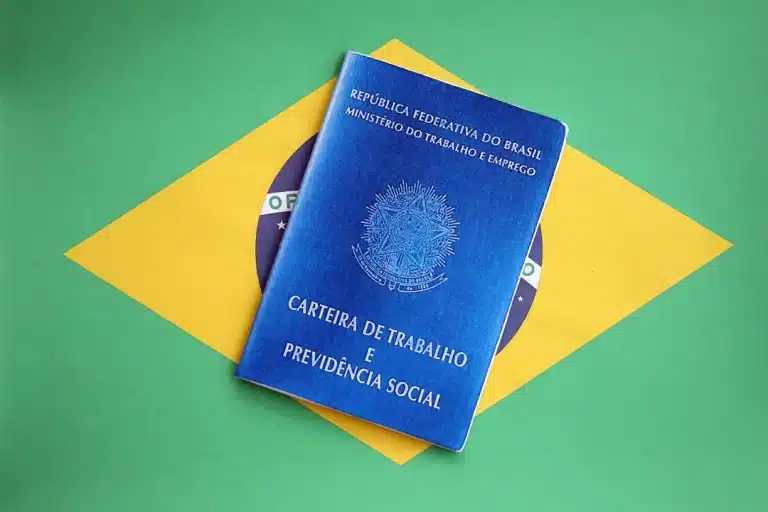

Brazil stands as Latin America’s most significant economy. For international businesses, the country offers a huge consumer base and access to high-quality talent, making it a primary destination for growth. Yet, this potential is paired with a known challenge: the demanding regulatory and tax systems within the country. Establishing a